Blind Exemption

A person who is blind, or the unmarried spouse or minor orphan of a deceased blind person is entitled to a reduction of their taxes, regardless of age or income.

The first $11,500 of taxable value of real and tangible personal property is exempt from taxation.

Every person applying for the exemption for the blind shall, on or before September 1 of each year, file an application with the county executive of the county in which the person resides.

The first year’s application shall be accompanied by a statement signed by a licensed ophthalmologist.

2015 Circuit Breaker/Tax Abatement Amounts

|

LOW |

HIGH |

CREDIT |

|---|---|---|

|

- |

10,778 |

939 |

|

10,779 |

14,372 |

819 |

|

14,373 |

17,964 |

702 |

|

17,965 |

21,556 |

526 |

|

21,557 |

25,151 |

409 |

|

25,152 |

28,531 |

234 |

|

28,532 |

31,702 |

115 |

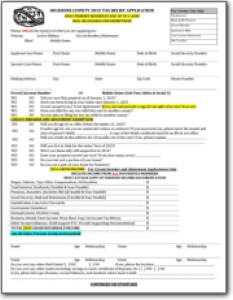

CHECKLIST- DEADLINE IS SEPTEMBER 1ST

Tax Exemptions:

1. IF YOU OWE BACK TAXES, they will need to be taken care of BEFORE you will receive abatement on the current year taxes.

2. You must OWN AND RESIDE at the primary residence/property you want the exemption applied to and at least lived in it for 10 months of the year. If the property is in a trust, you must be a trustee of the trust. The abatement will only cover your primary home and up to ONE (1) acre of ground.

3. You must provide proof of income from ALL SOURCES (everyone who lives in the home which could include but not limited to spouse/partner and children/grandchildren) with your application. (previous year income tax, OR 3 months of bank statements OR check stubs, OR a copy of the paper work you receive each year from your social security benefits)

4. Proof of disability must be on file in our office for Veteran or Blind Exemptions.

5. Active Military exemption persons must provide a duty roster.

6. You must sign and date the application.

7. You must apply before September 1st of each year or you may not be eligible for the abatement on your taxes.

2015 Tax Relief Application